Just five months into fiscal 2021, the US government has already run a budget deficit of over $1 trillion.

In a year of massive deficits, the US federal government charted its biggest monthly shortfall of fiscal year 2021 in February.

According to the Monthly Treasury Statement, the February deficit came in at $310.92 billion, pushing the fiscal 2021 budget shortfall to $1.05 trillion.

Prior to last year’s stimulus-fueled $3.13 trillion deficit, the US government had only run annual deficits over $1 trillion four times, all during the Great Recession. Uncle Sam has now managed to do it in just five months. The previous record deficit for the first five months of a fiscal year was $652 billion set back in 2010.

Keep in mind this doesn’t factor in any of the spending just approved in the $1.9 trillion “American Rescue Act.”

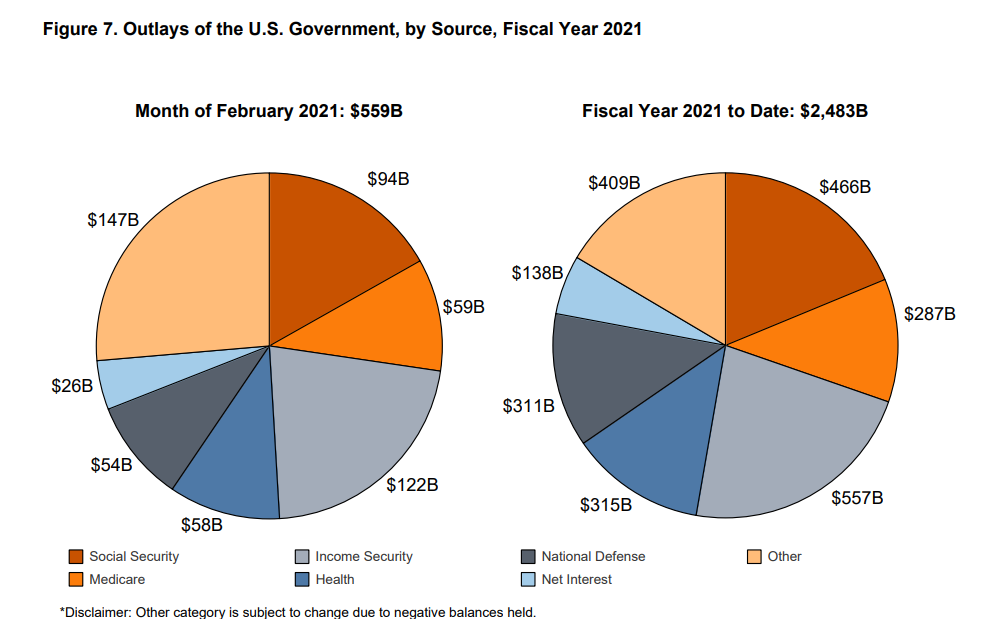

Last month, the US government spend another $559.24 billion. That was up 24.3% compared to February 2020. Including February outlays, total fiscal 2021 spending now stands at a staggering $2.48 trillion.

Federal government receipts in February came in at $248.31 trillion, also a 24.3% increase year-on-year. From October through February, government revenue is up 5.1% to $1.44 trillion

On March 1, the US national debt eclipsed $28 trillion for the first time. According to the National Debt Clock, the debt to GDP ratio stands at 129.8%. Despite the lack of concern in the mainstream, debt has consequences. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

Even without additional stimulus, the CBO estimates the 2021 deficit will hit $2.3 trillion. That would rank as the second-largest deficit in US history, behind only last year’s $3.13 trillion shortfall. The CBO also projects the national debt will swell to an unfathomable $35.3 trillion by 2031.

As Peter Schiff noted in a recent podcast, there seem to be increasing expectations on Wall Street that faster than expected economic growth thanks to stimulus will force the Federal Reserve to tighten monetary policy faster than expected. But this seems highly unlikely given that the central bank will have to monetize all of this debt. That means more bond purchases and more money printing.

The Federal Reserve makes all of this borrowing and spending possible by backstopping the bond market and monetizing the debt. The central bank buys US Treasuries on the open market with money created out of thin air (debt monetization). This creates artificial demand for bonds and keeps interest rates low. All of this new money gets injected into the economy, driving inflation higher. The Fed expanded the money supply by record amounts in 2020.

The Fed had worked itself between a rock and a hard place. It has to print trillions of dollars to monetize the massive deficits. But that is causing inflation expectations to run hot. That is putting upward pressure on interest rates. But you can’t have rising rates when your entire economy is built on debt. The only way the Fed can hold rates down is to buy more bonds, which means printing more money, which means even more inflation. You can see the vicious cycle. At some point, there is a fork in the road and the Fed will have to choose. Step up and address inflation and let rates rise, which will burst the stock market bubble and collapse the debt-based economy, or just keep printing money and eventually crash the dollar.

This article originally appeared on SchiffGold.

How Crypto Works?

How Crypto Works?  Why Is Crypto Down? The Truth.

Why Is Crypto Down? The Truth.  Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated

Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated  LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED

LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED  Kraft Heinz CEO says people must get used to higher food prices

Kraft Heinz CEO says people must get used to higher food prices