IN BRIEF

- Rothschild Investment buys 265,302 shares in Grayscale’s Ethereum Trust.

- It also purchased nearly 8,000 shares in the BTC trust in Q1 2021.

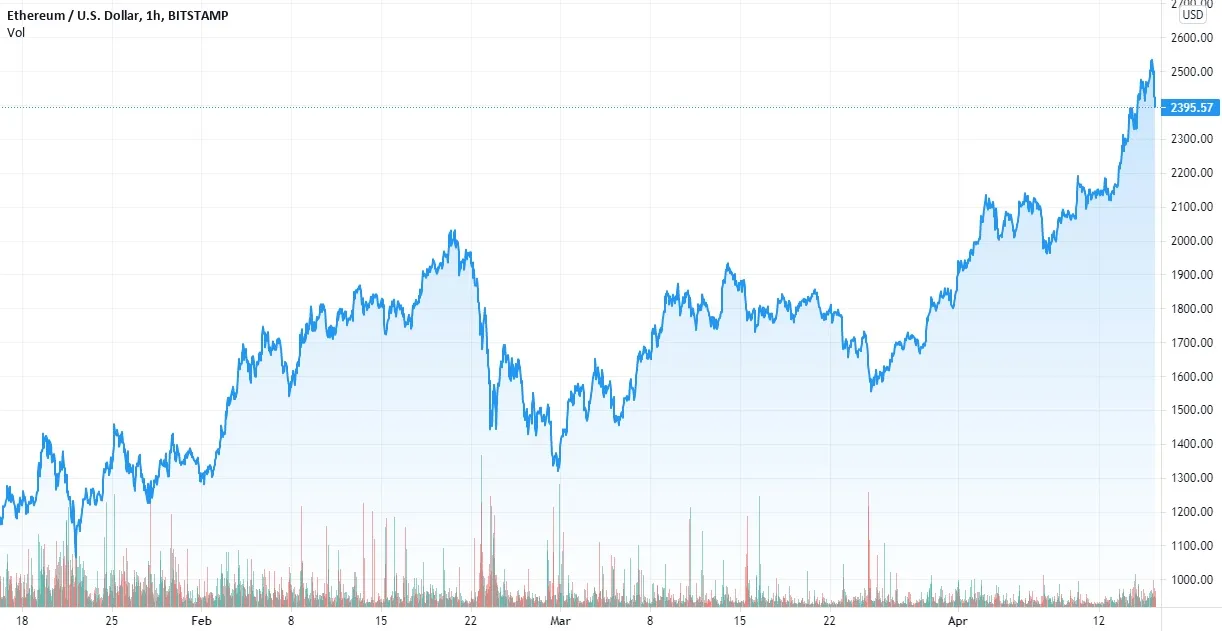

- ETH has been performing extremely well, hitting an ATH of $2,547 on April 16.

The Rothschild Investment asset management firm purchased $4.75 million worth of Grayscale Ethereum Trust Shares, as well 8,000 shares in the BTC Trust, in Q1 2021.

Asset management firm, Rothschild Investment, has purchased $4.75 million worth of ETH via the Grayscale Ethereum Trust, according to an SEC filing.

The firm bought an additional 8,000 shares in the BTC trust to bring its total to 38,346 shares.

Rothschild is a major asset management firm with over $1.1 billion in assets under management. The new purchase marks yet another major firm to further entrench itself in the crypto market.

This is the first time that the firm has invested in ETH.

Ethereum has performed phenomenally well in the past few weeks on the back of decentralized finance (DeFi), non-fungible tokens (NFT), and the market’s general rally. The asset hit a new all-time high of over $2,500 on April 15.

The arrival of MicroStrategy and Square last year set off a domino effect that spurred more market entrants. Such developments have contributed to the market’s value and also helped to legitimize the asset class.

Could ETH 2.0 send Ether even higher?

Ethereum is issuing upgrades to the protocol via a staggered release over the next two years. The highly anticipated ETH 2.0 kicked off with a beacon chain contract deployed on Dec. 1, 2020. Since then, the amount of ETH staked on the contract has shot up considerably, with Vitalik Buterin himself even contributing.

The changes expected in ETH 2.0 include sharding and Proof-of-Stake. The end result aims to make the Ethereum network faster, cheaper, and more efficient. Because gas issues have plagued the network in the past few months, investors will likely be happy to see new scaling solutions implemented.

The market appears to be quite optimistic about the ETH changes. This, along with niches like the burgeoning DeFi and NFT sectors, have investors very optimistic about its price potential and ability to compete.

How Crypto Works?

How Crypto Works?  Why Is Crypto Down? The Truth.

Why Is Crypto Down? The Truth.  Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated

Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated  LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED

LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED  Kraft Heinz CEO says people must get used to higher food prices

Kraft Heinz CEO says people must get used to higher food prices