Prominent analyst Willy Woo says that investors with diamond hands have bought the massive capitulation that drove Bitcoin from $59,000 to about $52,000 in a matter of hours.

In a new tweetstorm, Woo looks at on-chain data to determine the factors that led to the violent sell-off.

According to the on-chain analyst, a power interruption in a Chinese province contributed to the largest drop in Bitcoin’s processing power (hash rate) since November 2017.

“The power outage in Xinjiang (which powers a significant amount of the BTC mining network) was known before the BTC price crash”

Woo says that it is very likely that a whale who had insider knowledge of the events took advantage of the situation.

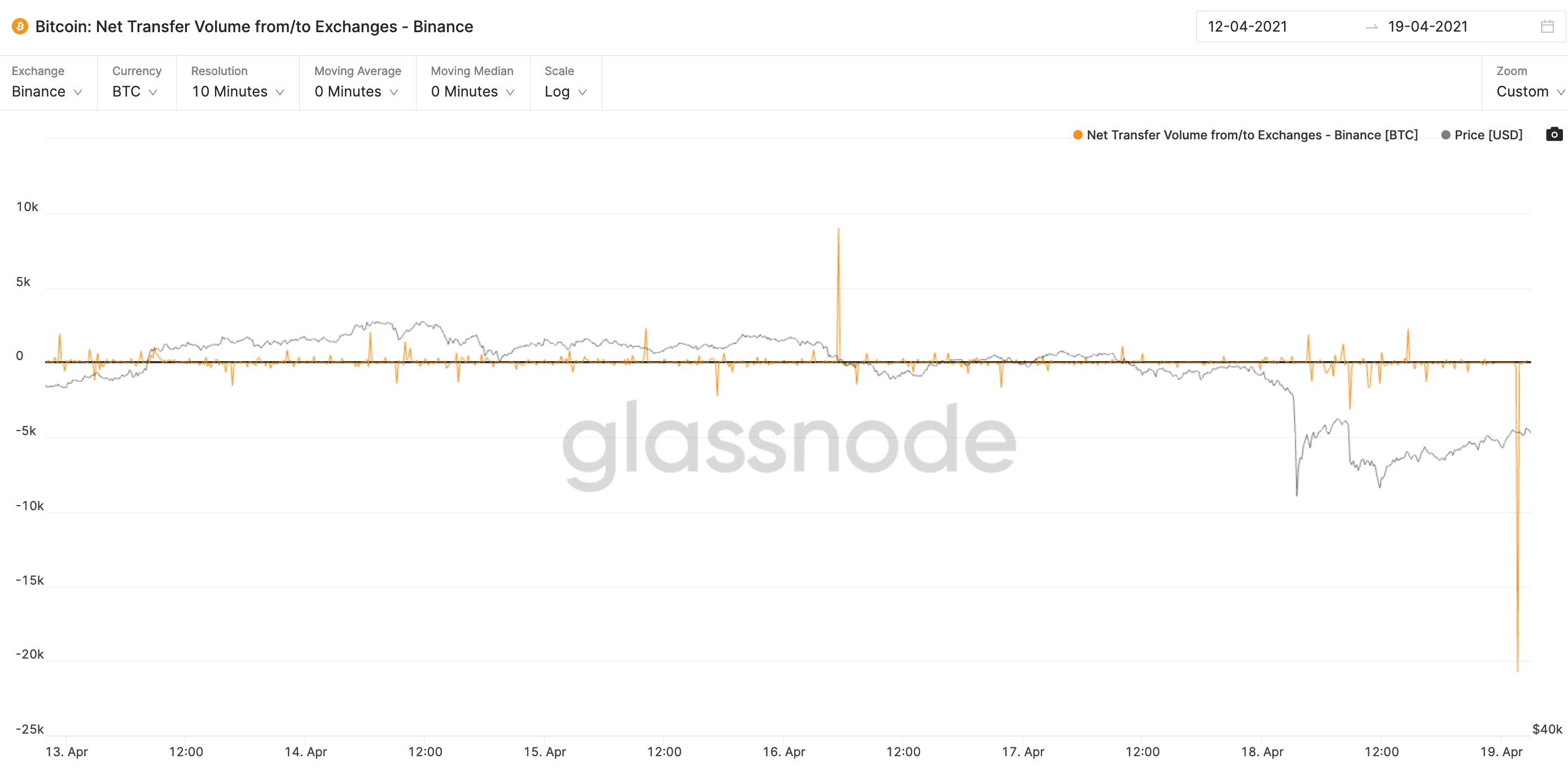

“9,000 BTC was sent into Binance. Read that as a sell-off of those coins. I’d note that Binance serves volume from Asia more than the West. It’s likely this was sent in from a whale with closer knowledge to happenings in China.”

Woo notes the event was compounded by a sell-off of quarterly futures contracts used by sophisticated traders on the derivative markets, which he highlights was already underway since April 13th.

The two catalysts were enough to push the price below the liquidation level of $59,000 and trigger a chain reaction of stop losses and sell downs, according to Woo. The analyst says that over $15.20 billion was liquidated across the crypto markets affecting the accounts of one million traders.

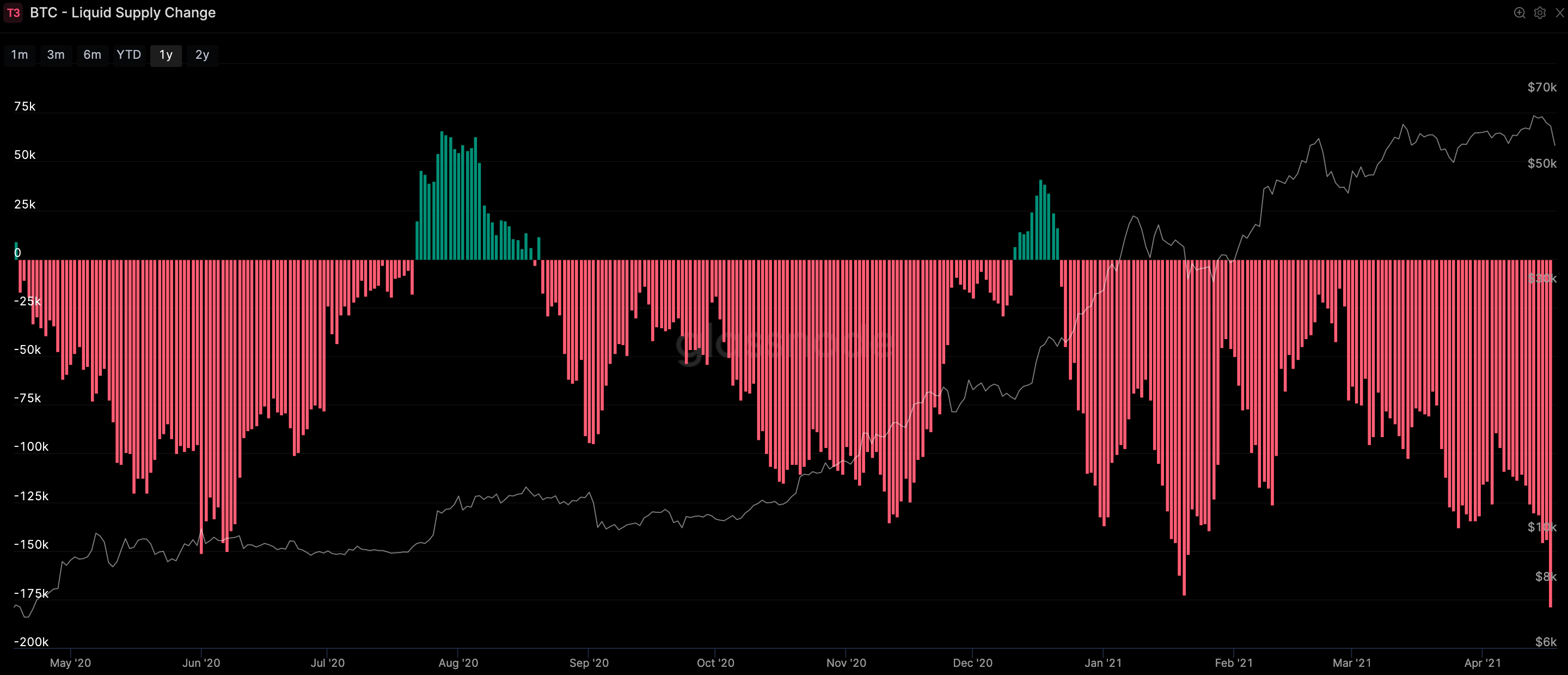

As Bitcoin took an abrupt nosedive in valuation, Woo reveals that buyers with very little history of selling BTC stepped in and bought the dip.

“Strong holders are buying this dip (red = Rick Astley genre of holders).”

Woo also highlights that a large entity bought tens of thousands of Bitcoin after the April 17th crash.

“9,000 BTC in, before the crash 20,700 BTC out, after the crash. I wonder if that’s the same whale?”

The on-chain analyst adds that Bitcoin is being strongly validated as a trillion-dollar asset as 13.5% of the entire BTC supply changed hands while the leading crypto asset traded above the $1 trillion valuation.

Woo concludes that on-chain metrics are now flashing buy the dip signals as long-term fundamentals remain strong.

“In simple terms, profit taking by longer-term investors is completing. Very little sell power left unless investors want to sell at a loss from their entry price. Unlikely in a bull market.”

How Crypto Works?

How Crypto Works?  Why Is Crypto Down? The Truth.

Why Is Crypto Down? The Truth.  Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated

Cleveland Clinic Bans Severely Ill Ohio Man From Kidney Transplant Because The Donor Isn’t Vaccinated  LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED

LOUISIANA WILL EXPUNGE YOUR CRIMINAL RECORD IF YOU AGREE TO GET VACCINATED  Kraft Heinz CEO says people must get used to higher food prices

Kraft Heinz CEO says people must get used to higher food prices